Most viewed 5 articles

Most liked 5 articles

Recent 5 articles

Frequently Asked Questions

-

Does Exness use mt4?

Exness Broker Supports a wide range of available trading platforms including Metatrader 4 in short MT4. As we all know, Metatrader 4 is the most popular and reliable source of trading platform for financial markets. You can download the MT4 trading platform right from the Broker Website. or just click this link – www.exness.com

-

How do you trade Exness?

The process is too simple to start. First of all, you need to make yourself registered on Broker official Website – www.exness.com

Here are the few steps that you need to follow.

- Make a registration from the Broker website by using your Email Address and Set a Password. You can learn the detailed process from our Exness Registration Article.

- Complete your Trading Profile and make it verify. You can learn the details from Exness Verification article.

- Choose your trading account as Exness offers variety of trading accounts as per clients need. such as Cent Account, Standard Account, Zero Account, RAW Acount and Pro Account. Choose any of these from your client cabinet.

- Make your first deposit by using any of your preffered payment gateway. But we do always reccomed to use Neteller or Skrill because it is safe and secure. You can learn the detailed deposit pocess by reviewing our Exness Deposit article.

- Download any of your preffered Trading Platform. You can use your smartphone or PC for these. You can choose any of these from the mentioed link – MT4, MT5, Mobile

- Start Trading based on your perfect trading stratgies.

Good Luck!

-

Where is Exness?

Exness was mainly Cyprus based Broker established in 2008. Currently, all of its operations and services are owned by Nymstar Limited which is located in Seychelles. The registered office of Nymstar Limited is at F20, 1st floor, Eden Plaza, Eden Island, Seychelles.

Exness Trading servers are mainly stated in the Netherlands. You can find more information from the Broker Website – www.exness.com

-

How do I open a real account on Exness?

Well, it is pretty simple. To open a real trading account you need to register yourself first. Please visit the broker official Website – www.exness.com and then create an account by using your registered email ID and set a password.

Here are some steps that you need to follow –

- Open Broker Website – www.exness.com

- Find the “New Account” Form and fill with your details such as your Region, valid email address, and then set a Password.

- After Registering Successfully, you will get a confirmation email with some valid details that you need to follow to complete your registration profile.

- Please check those details in the email and act as per instructions.

If you want to know more about the detailed account registration process then please have a look at our Exness Registration article.

-

What is the minimum deposit for Exness?

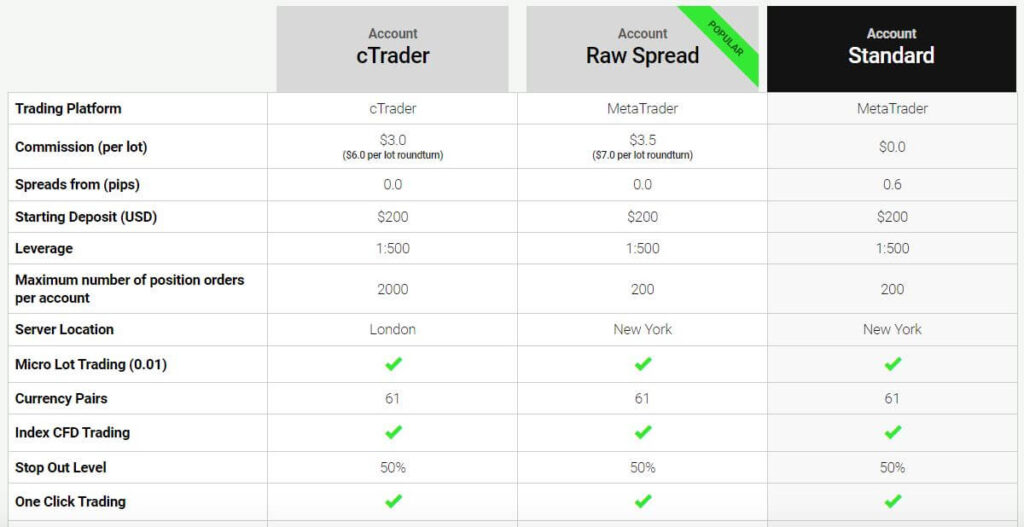

What is the minimum deposit for Exness? – The minimum deposit amount of Exness brokers start from $1 but it varies depending on their available trading account types up to $200.

Here are the minimum deposit requirements based on their trading accounts.

- Standard Account: Minimum Deposit will be $1

- Standard Cent Account: Minimum Deposit will be $1

- RAW Spread Account: Minimum Deposit will be $200

- ZERO Spread Account: Minimum Deposit will be $200

- Pro Account: Minimum Deposit will be $200

- Social Standard Account: Minimum Deposit will be $500

- Social Pro Account: Minimum Deposit will be $2000

Please be noted that the above-mentioned deposit amount will be applicable if you trying to use it through the broker cabinet. But if you want to use Exness Mobile Application to deposit then the Minimum Deposit amount requirements will be $10.If you want to learn more information regarding the deposit system then please refer to the Exness Deposit System article.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Does Exness allow capitec?

Does Exness allow capitec? Yes, Exness Broker supports Capitec Bank for South African Residents. If your trading account has been registered in South Africa then, you can get this facility by using their internet banking system.

You can top up your trading account in the South African rand via Internet banking, a payment method that allows you to transfer funds from your bank account to your Exness account.But before proceeding, we recommend making sure your trading account currency is RAND. Otherwise, currency conversion fees will apply. Details can be found on the broker website – www.exness.com

Here’s what you need to know about using Internet banking:

Exness Supported banks

For African Residents- ABSA

- Standard Bank

- First National Bank

- Nedbank

- Capitec Bank

- Investec

Minimum deposit USD 3 Maximum deposit USD 17,000 per transaction Minimum withdrawal USD 3 Maximum withdrawal USD 17,000 per transaction Deposit processing fee Free of charge Withdrawal processing fee Free of charge Deposit processing time Instant Withdrawal processing time 3 working days (Up to 72 hours) Here we have added the list of banks that support online transactions for Exness. You can use any of these banks to perform the transactions without any changes or fees. Please be noted, this banking channel information is applicable only to the residents of South Africa.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Does Exness allow scalping?

Does Exness allow scalping? – Yes! Exness broker allows automated trading by using an EA (Experts’ Advisor) or Robot for scalping or hedging. Also, this broker supports negative balance protection.

It means, if somehow for deep market volatility, your account blows out then the broker will adjust it to “ZERO” wherein in some cases another broker charges a negative amount. As a result, you will see your account balance will be in a negative format. More details can be found at the broker website – www.exness.com

The broker offers several special types of trading accounts that are specially designed for scalping and automated trading. Because of the lower spread and Zero spread features, this type of trading account is specially designed for professionals.

Here is a quick overview of the Exness Professional trading accounts.

RawZeroProMinimum deposit $200 $200 $200 Spread From 0.0 From 0.0 From 0.1 Commission Up to $3.50 for

each side per lotFrom $0.2 for

each side per lotNo commission Maximum leverage 1:Unlimited 1:Unlimited 1:Unlimited These above-mentioned accounts are mainly used for expert traders who mainly used to do Scalping to Robot Trading. Because of its lower spread, scalping will be much easier and your transaction costs will relatively lower.

On the other hand, who likes to trade in a longer timeframe like day, position, or swing trading then our recommendation is to use their Standard Trading Account because it offers the most benefits for trading.

You can get a detailed trading account review in the Exness Account Types article.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

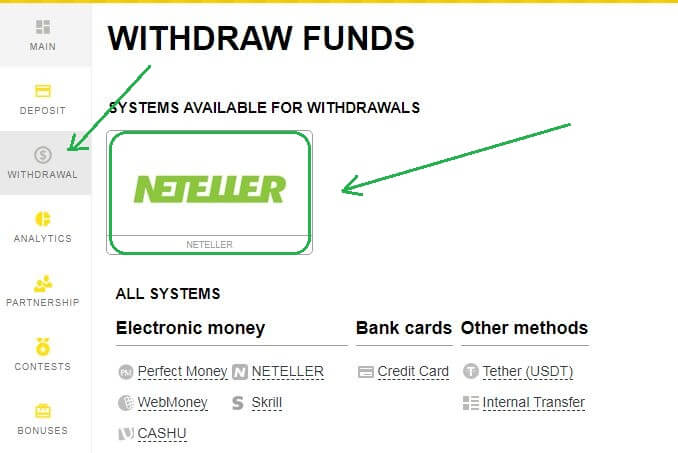

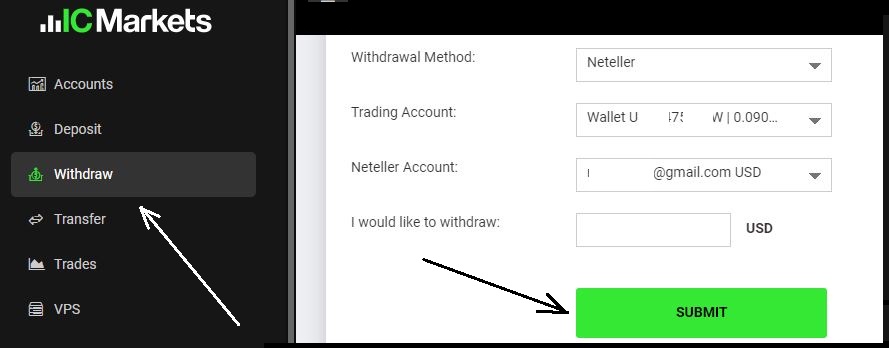

How to withdraw from your Exness account?

How to withdraw from your Exness account? – First of all, you need to visit the broker’s official website – www.exness.com, and then log in to your cabinet (personal area) by using your registered email address and password.

Then please navigate to the “Withdrawal” menu from the left side section and click it. Here you will the list of all available fund withdrawal options that the broker provides. Please choose your desired one and click the logo.

Choose the payment system that you want to use and follow the onscreen instructions. The details fund withdrawal process can be found in the Exness Withdrawal article.

Please make sure, you need to select the same payment methods that you have used while depositing in your trading account. For example, if you use Skrill Wallet to deposit then you need to use the same wallet while withdrawing funds. Otherwise, your payment request will be rejected.Here are some quick tips for a successful withdrawal request:

- Your withdrawals are proportional to your deposits;

- Your account has sufficient funds and is in good standing.

- Use the same gateway that you have used to deposit.

- Make sure you are aware of the withdrawal request processing time depending on the methods you want to use.

Here we have added a table that represents the lowest amount that can be withdrawn from Exness brokers trading account. Please be noted, based on your region, you may find some additional withdrawal options that are not listed in the below-mentioned box.

Online Wallet Crypto Wallet - Tether (USDT ERC20) – $100

- USD Coin (USDC ERC20) – $100

Bank Wire Transfer $250 Account Transfer $1 Source - www.exness.com

To know more about how to withdraw funds from your trading account, then please read this documented tutorial on Exness Withdrawal.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

How long does it take to withdraw money from Exness?

How long does it take to withdraw money from Exness? – Exness’s main facility is that the broker process all of their financial transaction automatically. From our trading experience, the broker has processed all of our deposits and withdrawal requests almost instantly without spending a single second.

If you use instant payment methods like Neteller, Skrill, or perfect money then funds will be processed almost instantly. If you choose to use a Credit card or Bank Transfer then it will take some time, depending on your payment gateways.

Here we have added a chart that represents the fund withdrawal execution time. Please be noted, based on your region, you may find some additional withdrawal options that are not listed in the below-mentioned box.

Online Wallet Crypto Wallet - Tether (USDT ERC20) – Instant

- USD Coin (USDC ERC20) – Instant

Bank Wire Transfer 1 Hour – 3 Days Account Transfer Almost Instant Source - www.exness.com

To know more about how to withdraw funds from your trading account, then please read this documented tutorial on Exness Withdrawal.

If your withdrawal request would not process instantly, then it will take up to 24 hours to execute. More information can be found at the broker website – www.exness.com

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Does Exness have binary options?

Does Exness have binary options? – Exness is a renowned retail forex broker, operating its services since 2008. This broker is mainly popular for Forex, Indicies, and CFD Trading. It does not offer any Binary Trading or Options Trading for traders. to know more, please refer to the broker website – www.exness.com

So, if you are looking for a binary broker then we recommend using IQ Option as this broker is well-regulated and reliable for binary or options trading.Exness Broker offers several types of trading accounts for different types of traders. No matter what type of trader you are, exness get you covered by offering their best trading services based on your demands.

Does not matter if your initial capital is low or you are a newbie, expert, or professional, this broker offers Cent, Standard, and RAW trading accounts.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

How do I verify my Exness account?

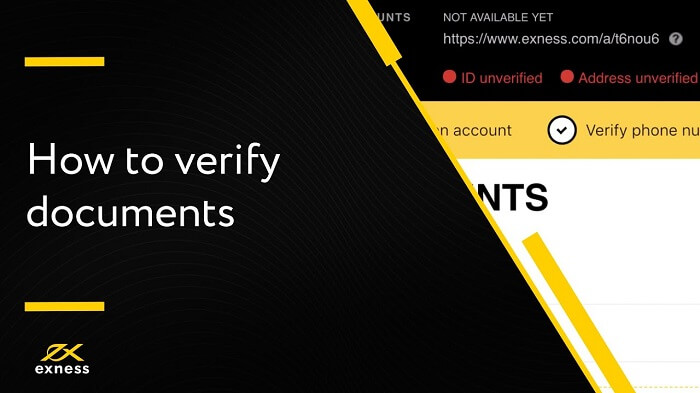

How do I verify my Exness account? – The account Verification process is too simple and straightforward. After registering an account from Exness Website – www.exness.com please log in to the client cabinet by using your registered email address and password.

Then you may see a notice for the completion of your account verification. You need to add your phone number, Upload your Identity Document, and Residential Proof to complete the verification.

We have already documented the detailed verification process in our Exness Verification article. Please feel free to go through it. First of all, you need to download Exness Mobile App on your smartphone and then follow the below instructions.

While uploading your Documents, please carefully maintain the below-mentioned details:

- Documents Must be Clear, Colored and the Image Quality must be good.

- For Identity Verification, you need to submit your NID/Passport/Driving License or any of the available govt. issued ID Card.

- For Address Verification, you need to submit the Court Bill/Agreement Copy/TAX Details/Bank Statement.

- Your Full name and address must be mentioned in the Document clearly.

- Documents must be valid and at least 90 days from the issuing date.

You can either upload the documents by using Exness Mobile Apps or can use your client cabinet (dashboard) to upload them. Both of the processes are easy and fast and only take less than 24 hours to review.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

What is the minimum withdrawal on Exness?

What is the minimum withdrawal on Exness? – If you use Neteller or Skrill for withdrawing funds from your account then the least amount will be $2. But in some cases, it varies depending on your preferred payment methods. Just like, If you want to use your Bank Card or Credit card, the least amount will be $10 and if you want to use your Bank Account then at least $6 should be withdrawn.

On the other hand, if you want to use Internal Transfer options then you can withdraw as low as $1 from your trading account. More information can be found here – www.exness.com

Here we have added a chart that represents the lowest amount that can be withdrawn from Exness brokers trading account. Please be noted, based on your region, you may find some additional withdrawal options that are not listed in the below-mentioned box.

Online Wallet - Neteller – $4

- Skrill – $10

- Perfect Money – $2

- Web Money – $1

Crypto Wallet - Tether (USDT ERC20) – $100

- USD Coin (USDC ERC20) – $100

Bank Wire Transfer $250 Account Transfer $1 Source - www.exness.com

To know more about how to withdraw funds from your trading account, then please read this documented tutorial on Exness Withdrawal.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

How can I block my trading account? – Exness

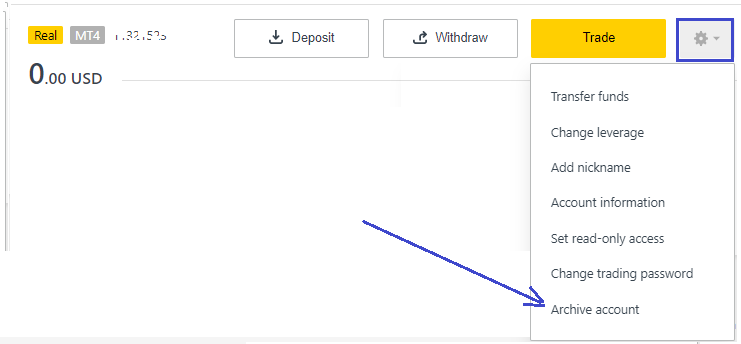

How can I block my trading account? – If you want to block any of your trading accounts then please make sure, the account does not have any funds and does not have any active or pending orders. Otherwise, the broker will not allow you to achieve that p[particular account.

Blocking Trading Account

Unfortunately, you won’t able to delete any of your registered trading accounts. You only can hide or archive or block it from your client cabinet and then that trading account will not be available to login into your trading terminal.

To do that, you need to login into your client cabinet or broker dashboard by using your registered email address and password.

after login, all of your created trading accounts can be found in your dashboard. from here select the account you want to archive and find a “⚙ Gear Icon” from the right. Check the below image for your reference.

after clicking the “Archive Account” the selected trading account will be hidden from your dashboard and will not be able to deposit or log in to any trading terminal.

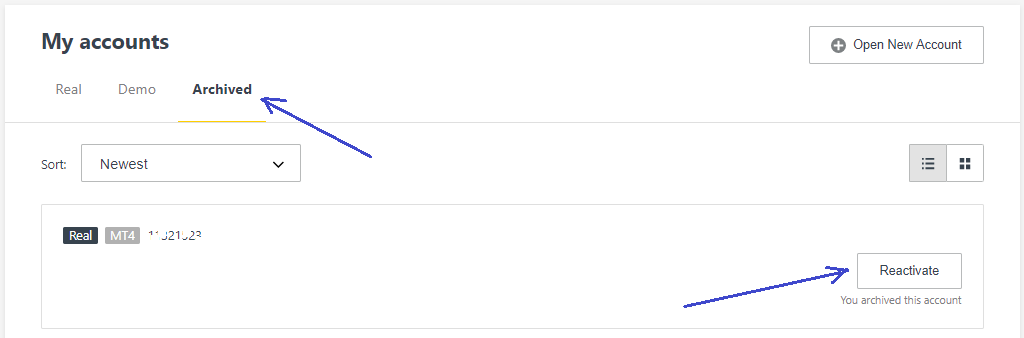

But if you want to use that account in the future, then you can reactivate it again from your client cabinet.

Please navigate to the “Archived” section in your account dashboard. Here you can see all of your already archived trading accounts. Please find the trading ID that you to restore or reactivate and click the “Reactivate” button situated on the right.

The trading account will be automatically restored and available again for trading. Please login to your trading terminal and by using the credentials and your trading id is ready for a fresh start.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

How do I delete my Exness account?

How do I delete my Exness account? – Make it a bit clear first. Do you really want to delete your Registered Exness account? or you are looking to Delete or archive your trading account? Well, we discuss both of them for your assistance.

Delete Registration

First of all, if you want to delete your exness registration then sorry to say, there is no automatic process to do it. You need to send an email to the broker support team and let them inform your issues in writing.

Then the support team will cross-check it and give you feedback as soon as possible. The support email address is – [email protected]

Here is the sample format that you need to use while contacting the broker support team.

Subject: Requesting to delete my Profile information and registration.

Email Body: please make sure to add the below-mentioned information while writing to the broker support team.

- Make sure to send an email from your registered exness email.

- Please make sure to withdraw all available funds before sending the cancelation request.

- Please mention your trading Account no and your Security PIN.

- If you forgot your security pin then please reset it. Here are the Exness PIN-related guidelines.

- Please add the reason for such action.

The broker support team then reviews your application and gets in touch with you as soon as possible. You can be notified via email or your registered phone number.

If you want to delete your exness account registration it means, you do not want to use the broker services anymore. So, make sure what you really want before proceeding further.Delete Trading Account

Unfortunately, you won’t able to delete it either. You only can hide or archive it from your client cabinet and then that trading account will not be available to login into your trading terminal. To do that you need to log in to your client cabinet or broker dashboard by using your registered email address and password.

after login, all of your created trading accounts can be found in your dashboard. from here select the account you want to archive and find a “⚙ Gear Icon” from the right. Check the below image for your reference.

after clicking the “Archive Account” the selected trading account will be hidden from your dashboard and will not be able to deposit or log in to any trading terminal.

But if you want to use that account in the future, then you can reactivate it again from your client cabinet.

just click on the “Archived” button then you can see all of your already archived trading accounts and click the “Reactivate” button situated on the right.

The trading account will be automatically restored and available again for trading. Please log in to your trading terminal by using the credentials and your trading id is ready for a fresh start.

If you archive any of your trading accounts then it will be hidden from your account dashboard and still, you can able to reactivate it from your end but if you want to completely delete that specific trading account then you need to contact the broker support team via email and let them know the reason just like the above-mentioned process.Exness then automatically deletes that specific account on your behalf. Before sending that request, please make sure to withdraw all the available balances from that particular account and make sure all positions are closed.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Does Exness have a bonus?

Does Exness have a bonus? – Exness does not offer any regular bonus campaigns like others such as Instaforex or XM. But is some occasion, the broker does offer some specific trading contests and reward-based competition.

These types of contests may offer based on geolocation or a specific segment of trading accounts. If the broker offers such a campaign, then you will get an email update automatically or you can visit the broker’s official website for more information – www.exness.com

Though Exness does not offer any regular bonus campaigns, FXBangladesh.com is here to give you the best chance to grab an offer.

$500 Lot back Bonus

This bonus campaign is specially designed by FX Bangladesh for its visitors and traders. Under this campaign, you will get a chance of willing $500 in a single month. You do not need to do anything else rather than trading. Trade yourself and you will get your reward on time.

Campaign Details:

- Trade 1 standard lot and earn a reward of $1 each time. If you are able to meet 500 lot during 30 days period then you will get an additional $500 as a reward.

- This reward is real money and you can withdraw via any wallet at any time. No restrictions will be applicable.

- If you are unable to meet the target lot, do not worry, you will get your lot back bonus whatever lot you have traded in particular 30 days. Ex. you traded 10 lot in the 30 days cycle so, your reward will be $30 and it will be credited on the next month.

- Any new and existing client of exness can enroll in this campaign. Even if you have multiple trading accounts, you can earn rewards for all of them.

Conditions:

- This campaign is entirely designed by FX Bangladesh on behalf of the Exness Broker. So, FX Bangladesh has the right to edit, modify or close the campaign at any time. The broker does not have any activities rather than transferring the reward to the clients as per our instructions.

- To participate in this campaign, you need to register a trading account by this link – https://fxbd.co/exness. Your trading account must be connected to our trading community.

- Only a Standard Trading Account is applicable to participate in this campaign.

- Trading volume is calculated if a trader performs trading in these mentioned trading assets – EUR/USD, GBP/USD, GBP/JPY, USD/CAD, AUD/USD, XAU/USD, USD/JPY, and EUR/GBP

- For every standard lot, you will get $1 as a reward. If you can meet 500 lots in 30 days then you will get an additional $500 extra. Your warning will be $500 for 500 Lots + an Additional $500 for reward = $1000 in total.

- Your reward earnings will be deposited automatically within 5 days of the following month. Exness broker will automatically deposit the rewards into your trading account.

- This campaign is designed for global visitors so, anyone from anywhere can join this campaign without any issues.

- Please make sure your real trading account has been registered under our trading community. In order to verify, you can share your trading ID with us by sending an email to [email protected]. Our team then verifies your trading ID and activates the campaign from the broker end.

- The campaign deadline will be 31st December 2023.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Does Exness allow EA?

Does Exness allow EA? – Exness allows using EA or ROBOT for automatic trading. They are offering Free VPS to all of their clients for a stable server connection. This server is being widely used for Automatic Trading.

You can Install any EA to broker Trading platforms such as MT4 or MT5 but we suggest using MT5 because this trading platform is a bit more advanced and more user-friendly for EA Based trading.

In addition, if you want automatic trading then our recommendation is to use their RAW trading account. Because its spread is too low and close to ZERO. A lower spread is always beneficial for Scalping or Automatic trading.

For more information can be found at the broker website – www.exness.com

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Can Exness be trusted?

Can Exness be trusted? – Exness Broker is operating its financial services since 2008 and till now, this broker is reliable and trustworthy for its strong regulation and trading privileges. This broker is well-known for its Low Spread, outstanding support, and fully automatic payment processing system.

From our experience, this is the only retail broker who processes any financial transactions automatically. that means like a deposit, you can withdraw your available funds within a second.Exness is operated by Nymstar Limited a Securities Dealer registered in Seychelles. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Reference

- Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. Reference. Exness (Cy) Ltd operates under the website www.exness.eu.

- Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729. Reference.

Exness (UK) Ltd operates under the website www.exness.uk. - Central Bank of Curaçao and Sint Maarten (CBCS) – Exness B.V. is a Securities Intermediary authorized and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Financial Services Commission (FSC) – Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Financial Sector Conduct Authority (FSCA) – Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Capital Markets Authority (CMA) – Tadenex Limited is authorized by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more and registration details.

Bottom line: If you are asking Can Exness be trusted? Our opinion is, Yes! this broker is completely reliable and trustworthy because of its strong regulations and Financial Transparency. Broker regularly publish their Financial Reports from their website and a full audit report prepared by a UK-based Audit firm name Deloitte. You can check Exness Audit Reports

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Is Exness Social Trading legit?

Is Exness Social Trading legit? to get the answer we need to dig deeper to know about the regulation of this broker. So, let’s replace the question with “Can I trust Exness?”

In simple words, Yes! You can start your trading carrier with this broker just because of their strong regulation, offered services, and outstanding customer support. This broker is well-known for its Low Spread, outstanding support, and fully automatic payment processing system.

From our experience, this is the only retail broker that processes any financial transactions automatically. which means like a deposit, you can withdraw your available funds within a second.The best way to choose any broker, you need to find out its regulation first.

Exness is operated by Nymstar Limited a Securities Dealer registered in Seychelles. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Reference

- Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. Reference. Exness (Cy) Ltd operates under the website www.exness.eu.

- Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729. Reference.

Exness (UK) Ltd operates under the website www.exness.uk. - Central Bank of Curaçao and Sint Maarten (CBCS) – Exness B.V. is a Securities Intermediary authorized and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Financial Services Commission (FSC) – Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Financial Sector Conduct Authority (FSCA) – Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Capital Markets Authority (CMA) – Tadenex Limited is authorized by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more about registration details.

Is Exness Social Trading legit? – As this broker is regulated by some top-class regulatory authorities so yes! you can start trading by using any type of trading account they offered.

Social Trading is mainly offered to those who do not have knowledge of trading or do not have enough time to check and follow the markets. Just deposit as low as $10 you can start copying trade from professional traders. All you need, just to download their social trading apps and register a trading account first.

If you want to know the detail of how their social trading really works and how can you participate just refer to this “Exness Social Trading” first.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Is Exness a good forex broker?

Is Exness a good forex broker? – If you want to know our view then the answer will be YES. Exness is a reliable and trustworthy retail forex broker for any type of trading. That means, if you are a Currency trader or want to invest in stock then we recommend using this broker for their outstanding facilities and strong regulations.

Since 2008 this broker is serving its traders in 17 different languages to feel their traders at home. Behind the mass popularity, the main advantages are their Instant Payment System.

From our experience, Exness is the only broker that processes any financial transactions automatically. It does not matter if you want to deposit or want o to withdraw funds from your trading account. Requests will be processed in a matter of seconds.So, you can trust this broker and start trading right now without any hesitation or confusion. more information can be found on the broker’s website – www.exness.com

To know more about their regulation and License details, please view this topic. Reference

To consider Exness as a Good and Reliable forex broker we investigate the below-mentioned things.

- Strong Regulations (Must have)

- Verified Social Media presence (Must have)

- Transparent Transections system

- Dedicated customer support team

- Audit Reports and Annual Financial Reports Publication.

These are the main key points that we find while recommending any broker for you. After spending a couple of months on real trading, we consider Exness to be a good and reliable forex broker and recommend to you. You can find more information on the broker’s official website – www.exness.com

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Is Exness a ECN broker?

Is Exness a ECN broker? – Exness is one of the most reliable Forex Brokers in the financial markets. Since 2008, it offers impressive trading facilities to its clients by offering professional trading accounts such as Standard, RAW, Zero, Cent, and Social Trading.

All of the above-mentioned trading accounts are offered by ECN pricing while trading. So, Yes! The broker supports the Electronic Communication Network (ECN) price to its offered trading accounts. You can learn from the broker website directly – www.exness.com

One of the most advantages of trading in ECN accounts is the “Lowest Spread”. As the quoted currencies prices are coming from an interbank system so, the spread remains low and the broker charges a little bit of commission from the traders’ entry.If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Is Exness regulated in Bangladesh?

Is Exness regulated in Bangladesh? – Well, exness broker is regulated in different countries with some foreign regulators but unfortunately, it is not regulated in Bangladesh. That means this broker does not have legal authorizations from Bangladesh Govt. and its Central Bank.

You may know, none of any retail brokers are regulated in Bangladesh as a part of Bangladesh Bank and its Foreign Currency exchange policies.But still, you can trade with exness and use all of its services and facilities without having any issues. As you may know, Exness is a very reliable and Trustworthy Broker and operating its business since 2008. The main factors of its popularity are mainly of its strong regulations and outstanding trading facilities. To know more, please visit the broker website – www.exness.com

Here we have listed the regulatory details of this Broker.

- Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Reference

- Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. Reference. Exness (Cy) Ltd operates under the website www.exness.eu.

- Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729. Reference.

Exness (UK) Ltd operates under the website www.exness.uk. - Central Bank of Curaçao and Sint Maarten (CBCS) – Exness B.V. is a Securities Intermediary authorized and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Financial Services Commission (FSC) – Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Financial Sector Conduct Authority (FSCA) – Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Capital Markets Authority (CMA) – Tadenex Limited is authorized by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Is Exness regulated in India?

Is Exness regulated in India? Well, exness broker is regulated in different countries with some foreign regulators but unfortunately, Exness is not regulated in India. That means this broker does not have legal authorizations.

You may know, none of any retail brokers are regulated in India as a part of India’s central bank and currency exchange policies.But still, you can trade with exness and use all of its services and facilities without having any issues. As you may know, Exness is a very reliable and Trustworthy Broker and operating its business since 2008. The main factors behind its popularity are mainly its strong regulations and outstanding trading facilities. To know more, please visit the broker website – www.exness.com

Here we have listed the regulatory details of this Broker.

- Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Reference

- Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. Reference. Exness (Cy) Ltd operates under the website www.exness.eu.

- Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729. Reference.

Exness (UK) Ltd operates under the website www.exness.uk. - Central Bank of Curaçao and Sint Maarten (CBCS) – Exness B.V. is a Securities Intermediary authorized and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Financial Services Commission (FSC) – Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Financial Sector Conduct Authority (FSCA) – Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Capital Markets Authority (CMA) – Tadenex Limited is authorized by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Is Exness trusted?

Exness Broker is operating its financial services since 2008 and till now, this broker is reliable and trustworthy for its strong regulation and trading privileges. This broker is well-known for its Low Spread, outstanding support, and fully automatic payment processing system.

From our experience, this is the only retail broker who processes any financial transactions automatically. that means like a deposit, you can withdraw your available funds within a second.Exness is operated by Nymstar Limited is a Securities Dealer registered in Seychelles. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Reference

- Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. Reference. Exness (Cy) Ltd operates under the website www.exness.eu.

- Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729. Reference.

Exness (UK) Ltd operates under the website www.exness.uk. - Central Bank of Curaçao and Sint Maarten (CBCS) – Exness B.V. is a Securities Intermediary authorized and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Financial Services Commission (FSC) – Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Financial Sector Conduct Authority (FSCA) – Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Capital Markets Authority (CMA) – Tadenex Limited is authorized by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more and registration details.

-

Is Exness regulated?

Exness is operated by Nymstar Limited is a Securities Dealer registered in Seychelles. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Reference

- Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. Reference. Exness (Cy) Ltd operates under the website www.exness.eu.

- Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729. Reference.

Exness (UK) Ltd operates under the website www.exness.uk. - Central Bank of Curaçao and Sint Maarten (CBCS) – Exness B.V. is a Securities Intermediary authorized and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Financial Services Commission (FSC) – Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Financial Sector Conduct Authority (FSCA) – Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Capital Markets Authority (CMA) – Tadenex Limited is authorized by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more and registration details.

-

Is Exness regulated in South Africa?

Is Exness regulated in South Africa? – Exness is one of the leading online-based retail forex brokers with several regulations and licenses from different parts of the world. Exness is regulated in South Africa because this broker is regulated by Financial Sector Conduct Authority (FSCA)

So any residents from South Africa now can create accounts and trade with Exness with more confidence and security. Exness got this license in the year 2020 and officially registered as a legal entity in the South African Region. You can learn more information from the official website – www.exness.com

Here we have listed the regulatory details of this Broker.

- Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Reference

- Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. Reference. Exness (Cy) Ltd operates under the website www.exness.eu.

- Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729. Reference.

Exness (UK) Ltd operates under the website www.exness.uk. - Central Bank of Curaçao and Sint Maarten (CBCS) – Exness B.V. is a Securities Intermediary authorized and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Financial Services Commission (FSC) – Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Financial Sector Conduct Authority (FSCA) – Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Capital Markets Authority (CMA) – Tadenex Limited is authorized by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Is Exness Trustworthy?

Is Exness Trustworthy? – Exness Broker is operating its financial services since 2008 and till now, this broker is reliable and trustworthy for its strong regulation and trading privileges. This broker is well-known for its Low Spread, outstanding support, and fully automatic payment processing system.

From our experience, this is the only retail broker who processes any financial transactions automatically. that means like a deposit, you can withdraw your available funds within a second.Exness is operated by Nymstar Limited a Securities Dealer registered in Seychelles. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Reference

- Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. Reference. Exness (Cy) Ltd operates under the website www.exness.eu.

- Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729. Reference.

Exness (UK) Ltd operates under the website www.exness.uk. - Central Bank of Curaçao and Sint Maarten (CBCS) – Exness B.V. is a Securities Intermediary authorized and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Financial Services Commission (FSC) – Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Financial Sector Conduct Authority (FSCA) – Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Capital Markets Authority (CMA) – Tadenex Limited is authorized by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more and registration details.

Bottom line: If you have the question Is Exness Trustworthy? in your mind. Our opinion is, Yes! this broker is completely reliable and trustworthy because of its strong regulations and Financial Transparency. Broker regularly publish their Financial Reports from their website and a full audit report prepared by a UK-based Audit firm name Deloitte. You can check it out Exness Audit Reports

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

Which country is Exness?

Which country is Exness? Exness is one of the most popular retail-based online forex brokers established in 2008 in Cyprus. This broker is located in Cyprus and right now it has several offices across the world. This broker offers trading services in over 16 different languages including Bangla.

This broker is reliable and trustworthy for its strong regulation and trading privileges. This broker is well-known for its Low Spread, outstanding support, and fully automatic payment processing system.

From our experience, this is the only retail broker who processes any financial transactions automatically. that means like a deposit, you can withdraw your available funds within a second.Exness Offices

Here were have listed all exness offices and their locations.

Country Location Cyprus 1, Siafi Street, Porto Bello, Office 401, Limassol United Kingdom (UK) 107 Cheapside, London Seychelles 9A CT House, 2nd Floor, Providence, Mahe South Africa Offices 307&308 Third Floor, North Wing, Granger Bay Court, Cape Town Curaçao Emancipatie Boulevard Dominico F. “Don” Martina 31 British Virgin Islands Trinity Chambers, P.O. Box 4301, Road Town, Tortola These are the listed office where exness operates its business. Except for these locations, they also appoint their representatives in several countries like India, Pakistan, Thailand, Malaysia, Bangladesh, Indonesia, Vietnam, China, Nigeria, Cambodia, Singapore, Dubai, Saudi Arabia, and many more. You can find more information about their office locations directly from the broker website www.exness.com

Exness Regulations

Exness is operated by Nymstar Limited a Securities Dealer registered in Seychelles. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Reference

- Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. Reference. Exness (Cy) Ltd operates under the website www.exness.eu.

- Exness (UK) Ltd is an Investment Firm, authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the Financial Services Register number 730729. Reference.

Exness (UK) Ltd operates under the website www.exness.uk. - Central Bank of Curaçao and Sint Maarten (CBCS) – Exness B.V. is a Securities Intermediary authorized and regulated by the Central Bank of Curaçao and Sint Maarten with license number 0003LSI.

- Financial Services Commission (FSC) – Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Financial Sector Conduct Authority (FSCA) – Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024.

- Capital Markets Authority (CMA) – Tadenex Limited is authorized by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker with license number 162.

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more and registration details.

If you want to learn more, please have a look at the Exness Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the Exness FAQ Section to find your answers.

-

How can I get FBS Level Up Bonus?

How can I get FBS Level Up Bonus? – FBS is offering up to a $140 Free No Deposit Bonus also known as the LEVEL UP BONUS to all newly registered FBS members. Under this campaign, you do not need to invest your own fund. Your trading account will be credited the bonus amount and you will get 20 Trading Days to prove yourself.

Though you can not withdraw the bonus amount, the entire profit can be withdrawn without any restrictions. This bonus campaign is ideal for those who plan to switch their broker or start their trading carrier as a newbie.

Level Up Bonus Offer

You will get up to $140 Free trading capital which can be used in real trading and to meet certain criteria, you can completely withdraw your profit. Please be noted, the bonus amount will not be available to withdraw but you can withdraw your profit with ease.

Campaign Summary

Types of bonuses No deposit bonus Bonus user For All Maximum bonus amount $140 Bonus registration link Bonus Registration link Bonus Duration Up to 20 days from crediting Applicable to new customers Applicable Multiple account holders Not Applicable Withdrawal Conditions Only profit is withdrawable

Bonus Rules- First of all, please signup for a trading account from the broker’s official website www.fbs.com. You do not need to verify your account but need to verify your email address. Please complete the account registration process accordingly and if you have any doubts, you can check our FBS Account Registration Guide.

- After that, you need to connect your “Facebook Account” with the broker’s personal area section. Please be noted, you can only connect one Facebook account to get the bonus. Navigate to your Client Cabinet and add your Facebook profile here.

- Once you have done the above-mentioned things, your account will be credited $70. Now you need to download FBS Smart App and can get an additional $70 for free. Here is the calculation: $70 for registration + $70 for App Download. To download the app, please click this link and you will be redirected to the relevant apps page base on your smart device OS. FBS Smart App ->

- If you do not wish to download or use their trading app, it is ok! in that case, you will get only $70 as a bonus.

- Need to trade 5 Lots within this 20 days duration and a maximum of 5 days can be missed for trading. If you do not trade 6 Days within the campaign period then your bonus amount will be deducted as per the broker policy.

- The following options are prohibited: locking/hedging, expert advisors (EA), and ladder strategy (it is not allowed to open a new deal in the same direction within an hour after the closure of the previous deal).

- Each client/computer/IP can open only one Level Up Bonus account. It is prohibited to work through proxies or use any IP-address modifying software. Opening the second Level Up Bonus account is impossible even after bonus funds are charged off.

- It is important to be acknowledged, the bonus amount will remain in your account for the next 20 trading days. During this time you need to meet all the criteria that the broker stated to withdraw your profit. For the detailed terms please follow this link ->

If you want to learn more, please have a look at the FBS Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the FBS FAQ Section to find your answers.

-

How can I get 140$ on FBS?

How can I get 140$ on FBS? – FBS is offering up to a $140 Free No Deposit Bonus also known as the LEVEL UP BONUS to all newly registered FBS members. Under this campaign, you do not need to invest your own fund. Your trading account will be credited the bonus amount and you will get 20 Trading Days to prove yourself.

Though you can not withdraw the bonus amount, the entire profit can be withdrawn without any restrictions. This bonus campaign is ideal for those who plan to switch their broker or start their trading carrier as a newbie.

Level Up Bonus Offer

You will get up to $140 Free trading capital which can be used in real trading and to meet certain criteria, you can completely withdraw your profit. Please be noted, the bonus amount will not be available to withdraw but you can withdraw your profit with ease.

Campaign Summary

Types of bonuses No deposit bonus Bonus user For All Maximum bonus amount $140 Bonus registration link Bonus Registration link Bonus Duration Up to 20 days from crediting Applicable to new customers Applicable Multiple account holders Not Applicable Withdrawal Conditions Only profit is withdrawable

Bonus Rules- First of all, please signup for a trading account from the broker’s official website www.fbs.com. You do not need to verify your account but need to verify your email address. Please complete the account registration process accordingly and if you have any doubts, you can check our FBS Account Registration Guide.

- After that, you need to connect your “Facebook Account” with the broker’s personal area section. Please be noted, you can only connect one Facebook account to get the bonus. Navigate to your Client Cabinet and add your Facebook profile here.

- Once you have done the above-mentioned things, your account will be credited $70. Now you need to download FBS Smart App and can get an additional $70 for free. Here is the calculation: $70 for registration + $70 for App Download. To download the app, please click this link and you will be redirected to the relevant apps page base on your smart device OS. FBS Smart App ->

- If you do not wish to download or use their trading app, it is ok! in that case, you will get only $70 as a bonus.

- Need to trade 5 Lots within this 20 days duration and a maximum of 5 days can be missed for trading. If you do not trade 6 Days within the campaign period then your bonus amount will be deducted as per the broker policy.

- The following options are prohibited: locking/hedging, expert advisors (EA), and ladder strategy (it is not allowed to open a new deal in the same direction within an hour after the closure of the previous deal).

- Each client/computer/IP can open only one Level Up Bonus account. It is prohibited to work through proxies or use any IP-address modifying software. Opening the second Level Up Bonus account is impossible even after bonus funds are charged off.

- It is important to be acknowledged, the bonus amount will remain in your account for the next 20 trading days. During this time you need to meet all the criteria that the broker stated to withdraw your profit. For the detailed terms please follow this link ->

If you want to learn more, please have a look at the FBS Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the FBS FAQ Section to find your answers.

-

Is FBS real or Fake?

Is FBS real or fake? – FBS Broker is operating its financial services since 2010 and till now, this broker is reliable and trustworthy for its strong regulation and trading privileges. This broker is well-known for its Low Spread, outstanding support, and different types of trading accounts.

From our experience, this broker is ideal for those who want to start their trading journey as a newbie. From their Micro Account to ECN account, you can just only start trading by depositing as low as $1.FBS is operated by FBS Markets Inc. is a Securities Dealer registered in Belize. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- FBS Markets Inc.; Registration No. 119717; FBS Markets Inc is regulated by IFSC, license IFSC/000102/124 Reference

- FBS (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the name of Tradestone Limited with license number 353534. Reference.

Tradestone Limited operates under the website www.fbs.eu; www.fbs.eu; www.fbs.com; www.esfbs.com; www.fbs-china.cn; www.fbs-india.com; www.fbs.ae; www.fbs.co.th; www.fbs.com; www.fbs.com.bd; www.fbsfx.pk; www.fbsmy.com; www.frbfs.com; www.fxfbs-idn.com; www.jpfbs.com; www.kofbs.com; www.laofbs.com; www.ptfbs.com; www.trader-fbs.online; www.vnfbs.com;

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more.

You can find more information at the broker’s official website – www.fbs.com

If you want to learn more, please have a look at the FBS Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the FBS FAQ Section to find your answers.

-

Is FBS good for beginners?

Is FBS good for beginners? FBS is one of the leading retail forex brokers and the most popular in the forex industry. Their popularity begins when they started to offer different types of trading accounts for different types of traders.

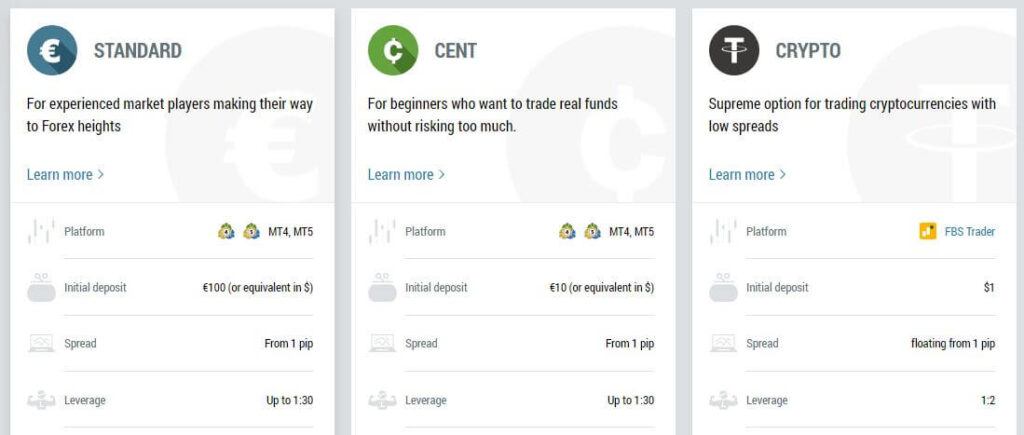

No matter what type of trader you are, FBS Broker got you covered by offering different services based on their client’s needs. They are offering mostly 3 Types of trading accounts for beginners.

If you are a newbie or a beginner then we recommend using their CENT or MICRO Trading account. These accounts are specially designed for newbies if your initial capital is low. You can use their cent account by depositing as low as $1 and for Micro account, it requires only $5 to start.FBS Broker is beginner friendly reliable and trustworthy broker. You can start trading without thinking twice but we recommend using their standard account as this account offers the most benefits for individual traders. If you want to know more, please have a look at our FBS Standard Account review article.

If you want to learn more, please have a look at the FBS Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the FBS FAQ Section to find your answers.

-

Can I trade with $1 on FBS?

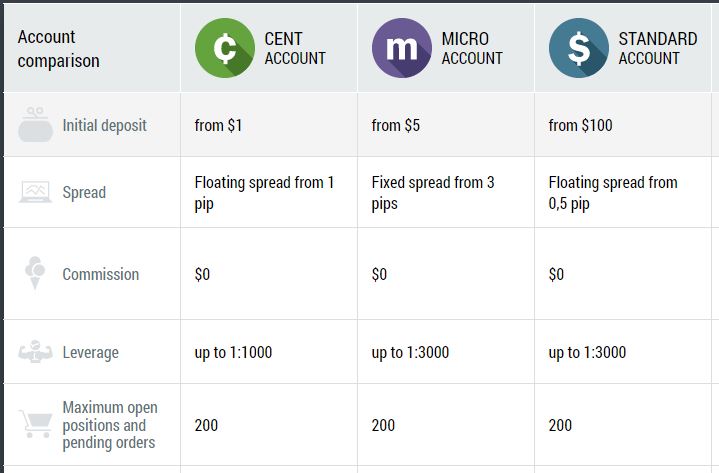

Can I trade with $1 on FBS? – FBS Broker is offering different types of trading accounts for different types of traders and the deposit requirements is different based on the trading accounts that you want to choose.

Yes! You can start trading with $1 at FBS Broker to their CENT and Crypto Trading accounts. If you choose to use their MICRO account then the lowest deposit amount will be $5 and $100 is required to use their standard account.

FBS is offering different types of trading accounts to their clients and the deposit requirement is different based on the account you want to use. You can deposit as low as $1 to start trading in this broker. Here is a quick comparison, that can help you to understand the deposit requirement based on the trading accounts.

Source - www.fbs.com

You can deposit as low as $1 to start trading with this broker but we recommend using their standard account as this account offers the most benefits for individual traders. If you want to know more, please have a look at our FBS Standard Account review article.But if you are a resident of the European Union then your deposit requirement will be different as per their regulatory policies and EU Guidelines. Here is a quick comparison.

Source - www.fbs.eu

For EU Residents the Lowest deposit amount will be €10 for the CENT Account and €100 will be required to start their STANDARD account. Please be noted, only residents from the European Economic Area (EEA) countries can use this domain www.fbs.eu.

If you want to learn more, please have a look at the FBS Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the FBS FAQ Section to find your answers.

-

Is FBS Broker regulated in South Africa?

Is FBS Broker regulated in South Africa? – FBS is a global-based retail forex broker, operating its business from Limassol, Cyprus. Currently, the broker support account registration from South Africa and other countries except for the USA, Israel, the Islamic Republic of Iran, and Myanmar.

FBS is not regulated in South Africa and the broker does not have any license or regulations from the Financial Sector Conduct Authority (FSCA) but all the residents from Africa can Register and Open a trading account without any issues.Outside of European Economic Area (EEA), the broker offers its services by using its IFSC Regulation operated on the www.fbs.com domain.

On the other hand, if you are a resident of the European Economic Area (EEA) then you can use their CySEC Regulated Services provided by FBS (Tradestone Ltd) through their domain – www.fbs.euRegulations

FBS is operated by FBS Markets Inc. a Securities Dealer registered in Belize. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- FBS Markets Inc.; Registration No. 119717; FBS Markets Inc is regulated by IFSC, license IFSC/000102/124 Reference

- FBS (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the name of Tradestone Limited with license number 353534. Reference.

Tradestone Limited operates under the website www.fbs.eu; www.fbs.eu; www.fbs.com; www.esfbs.com; www.fbs-china.cn; www.fbs-india.com; www.fbs.ae; www.fbs.co.th; www.fbs.com; www.fbs.com.bd; www.fbsfx.pk; www.fbsmy.com; www.frbfs.com; www.fxfbs-idn.com; www.jpfbs.com; www.kofbs.com; www.laofbs.com; www.ptfbs.com; www.trader-fbs.online; www.vnfbs.com;

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more.

You can find more information at the broker’s official website – www.fbs.com

If you want to learn more, please have a look at the FBS Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the FBS FAQ Section to find your answers.

-

Is FBS Broker legal in Bangladesh?

Is FBS Broker legal in Bangladesh? – FBS is a global-based retail forex broker, operating its business from Limassol, Cyprus. Currently, the broker support account registration from Bangladesh and other countries except for the USA, Israel, the Islamic Republic of Iran, and Myanmar.

None of any retail forex brokers are authorized and legally registered in Bangladesh. According to, Bangladesh Securities and Exchange Commission (SEC), forex brokers are not required to authorize to accept residents of Bangladesh as their customers.

But, any resident from Bangladesh can open a trading account in FBS Broker and use all of its services without having issues.More information can be found at the broker’s website – www.fbs.com

Till today, there are no specific rules or regulations for forex trading in Bangladesh so, trading is not illegal here but the Broker is not permitted to operate its business as a regional office. But you can easily make a registration with this broker and start trading without any problem.

FBS is not regulated in Bangladesh and the broker does not have any license or regulations from the Securities and Exchange Commission (SEC) but all the residents from Bangladesh can Register and Open a trading account without any issues.Outside of European Economic Area (EEA), the broker offers its services by using its IFSC Regulation operated on the www.fbs.com domain.

On the other hand, if you are a resident of the European Economic Area (EEA) then you can use their CySEC Regulated Services provided by FBS (Tradestone Ltd) through their domain – www.fbs.euRegulations

FBS is operated by FBS Markets Inc. a Securities Dealer registered in Belize. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- FBS Markets Inc.; Registration No. 119717; FBS Markets Inc is regulated by IFSC, license IFSC/000102/124 Reference

- FBS (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the name of Tradestone Limited with license number 353534. Reference.

Tradestone Limited operates under the website www.fbs.eu; www.fbs.eu; www.fbs.com; www.esfbs.com; www.fbs-china.cn; www.fbs-india.com; www.fbs.ae; www.fbs.co.th; www.fbs.com; www.fbs.com.bd; www.fbsfx.pk; www.fbsmy.com; www.frbfs.com; www.fxfbs-idn.com; www.jpfbs.com; www.kofbs.com; www.laofbs.com; www.ptfbs.com; www.trader-fbs.online; www.vnfbs.com;

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more.

You can find more information at the broker’s official website – www.fbs.com

If you want to learn more, please have a look at the FBS Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the FBS FAQ Section to find your answers.

-

What is the minimum deposit for FBS?

What is the minimum deposit for FBS? FBS is one of the leading online-based retail forex brokers and gain popularity by offering its financial services in over 150 countries. According to the broker’s website, more than 230 million traders are using FBS, and 48% of their clients consider their profits from FBS their main source of income. So, you can consider this broker to be trusted and reliable.

FBS is offering different types of trading accounts to their clients and the deposit requirement is different based on the account you want to use. You can deposit as low as $1 to start trading in this broker. Here is a quick comparison, that can help you to understand the deposit requirement based on the trading accounts.

Account

CENTMICROSTANDARDZEROECNCRYPTOInitial deposit$1 $5 $100 $500 $1000 $1 SpreadStarts 1 pip 3 pips Starts 0,5 pip 0 pip Starts -1 pip Starts 1 pip Commission$0 $0 $0 $20/lot $6 0.05% for opening & 0.05% for closing positions up to 1:1000 up to 1:3000 up to 1:3000 up to 1:3000 up to 1:500 up to 1:5 source - www.fbs.com

You can deposit as low as $1 to start trading with this broker but we recommend using their standard account as this account offers the most benefits for individual traders. If you want to know more, please have a look at our FBS Standard Account review article.On the other hand, for detailed account comparisons please have a look at the FBS Trading Accounts review article.

If you want to learn more, please have a look at the FBS Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the FBS FAQ Section to find your answers.

-

Can I trust FBS broker?

Can I trust FBS broker? – “Do not judge a book by its cover” is a proverb that you may know. So, you can not find the difference by looking at the broker’s attractive website and social media posts. As a retail forex broker is working online so there will be a high chance of getting scammed. To avoid such a scenario, you need to find a good and reliable broker who can ensure your account, deposit amount, and trading safety.

So the question is, how can I find a reliable and trustworthy forex broker? Well, that will be a difficult and complicated process that you need to follow. Do not worry, here we come to make your life a bit easier. In today’s article, we are going to find out how can you trust a broker like FBS for your future trading.

Summary: FBS is one of the leading retail forex brokers whom you can trust completely without having any issues. They have highly decorated regulatory bodies and got their licenses from different parts of the world. Since its establishment in 2009, they are now offered its financial services to over 150 countries and almost 23 million traders have been registered. Source – www.fbs.com

So you may ask yourself, does this information enough to judge a broker? Well, it is not! Our compliance team spends over 140 hours of real trading with this broker and finds out the overall pattern of their service offerings that fit our trust score criteria. To judge any broker, you need to find the below-mentioned things thoroughly.

- Broker Regulations and License details (Must have).

- Broker Social Media Profiles and Verification (Must have).

- Transactions systems and conditions.

- Execution and stop-out rules.

- Client Agreements.

- Customer support system.

- Educational guidelines and qualities.

These are some criteria that we are going to check while reviewing any forex broker for you. If any of these are missing then we do not recommend that broker for your trading. So, You can trust our review and check the references that we have mentioned in this review article.

FBS Broker is offering different types of trading accounts for different types of traders. No matter what type of trader you are, you will get everything from FBS. We are most impressed by their regulations and their transactions systems.

Regulations:

FBS is operated by FBS Markets Inc. a Securities Dealer registered in Belize. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- FBS Markets Inc.; Registration No. 119717; FBS Markets Inc is regulated by IFSC, license IFSC/000102/124 Reference

- FBS (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the name of Tradestone Limited with license number 353534. Reference.

Tradestone Limited operates under the website www.fbs.eu; www.fbs.eu; www.fbs.com; www.esfbs.com; www.fbs-china.cn; www.fbs-india.com; www.fbs.ae; www.fbs.co.th; www.fbs.com; www.fbs.com.bd; www.fbsfx.pk; www.fbsmy.com; www.frbfs.com; www.fxfbs-idn.com; www.jpfbs.com; www.kofbs.com; www.laofbs.com; www.ptfbs.com; www.trader-fbs.online; www.vnfbs.com;

NB: Here, we have listed the regulation and its detailed information. If you want to check the broker regulation details, please click the “Reference” link to know more.

You can find more information at the broker’s official website – www.fbs.com

If you want to learn more, please have a look at the FBS Broker section. We have also added a FAQ section where you can find the most common answers. Please refer to the FBS FAQ Section to find your answers.

-

Is FBS Broker legal in Nigeria?

Is FBS Broker legal in Nigeria? – FBS is a global-based retail forex broker, operating its business from Limassol, Cyprus. Currently, the broker support account registration from Nigeria and other countries except for the USA, Israel, the Islamic Republic of Iran, and Myanmar.

Though the broker is not regulated by the Securities and Exchange Commission of Nigeria, But, any resident from Nigeria can open a trading account with FBS Broker and use all of its services without having issues.More information can be found at the broker’s website – www.fbs.com

FBS is not regulated in Nigeria and the broker does not have any license or regulations from the Central Bank of Nigeria (CBN) but all the residents from Nigeria can Register and Open a trading account without any issues.Outside of European Economic Area (EEA), the broker offers its services by using its IFSC Regulation operated on the www.fbs.com domain.

On the other hand, if you are a resident of the European Economic Area (EEA) then you can use their CySEC Regulated Services provided by FBS (Tradestone Ltd) through their domain – www.fbs.euRegulations

FBS is operated by FBS Markets Inc. a Securities Dealer registered in Belize. This broker is mainly popular just because of its strong regulation and outstanding customer support. Here is the detailed information about Exness Regulation as follows.

- FBS Markets Inc.; Registration No. 119717; FBS Markets Inc is regulated by IFSC, license IFSC/000102/124 Reference