Medium-term traders hold positions for a few days, taking advantage of fundamental factors and technical setups. Compared to scalping and long-term trading, medium-term trading has the lowest capital requirements. However, there are fewer trade opportunities for this type of trading.

This type of trading involves looking at multiple time frames and the use of technical indicators, such as moving averages and stochastics. Aside from those, it also makes use of support and resistance levels, trend lines, Fibonacci retracements and extensions, and pivot points. Candlestick formations and chart patterns are also useful.

Trade ideas are generated by looking at whether the indicators align. For instance, when there is an inverse head and shoulders pattern on the hourly chart and the stochastics made an upward crossover in the oversold area, one could trade the breakout by placing an entry order above the neckline resistance.

Exit points (stop loss and take profit areas) are usually placed at key levels, around support and resistance levels or psychological levels.

Fundamentals are also taken into account by closing or modifying a particular trade when an economic report was just released or is about to be released

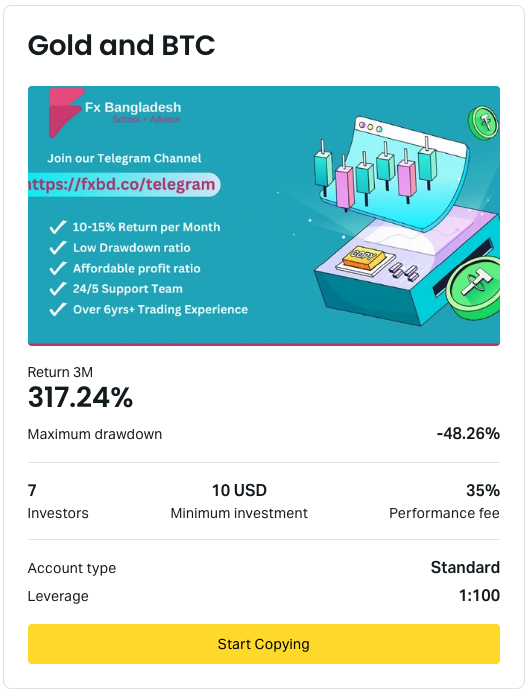

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.