Earlier in Forex, there was only a way to trade through a certain amount. This particular amount is known as “Lot”. To put it simply, the unit or amount you buy/sell at a currency pair for trading is called Lot. If we look back a little, before the introduction of retail forex brokers, those of us who were interested in investing in forex trading, could not trade even if they wanted to, and the main reason for this was that we could not take the minimum amount of entry because it was much higher then a single investor can effort. Over time, Retail Forex Brokers have reduced this amount so much that you can start trading with $5 today if you want.

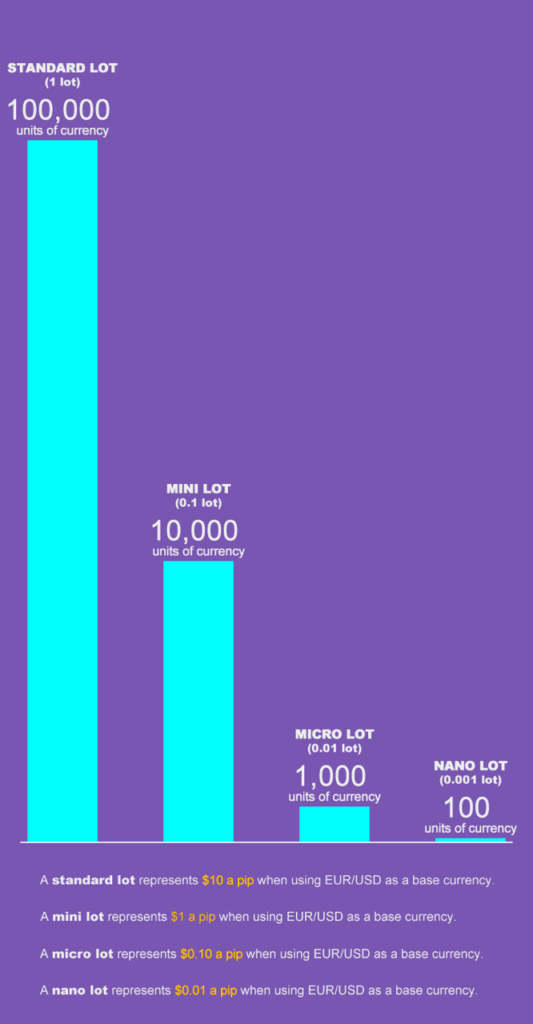

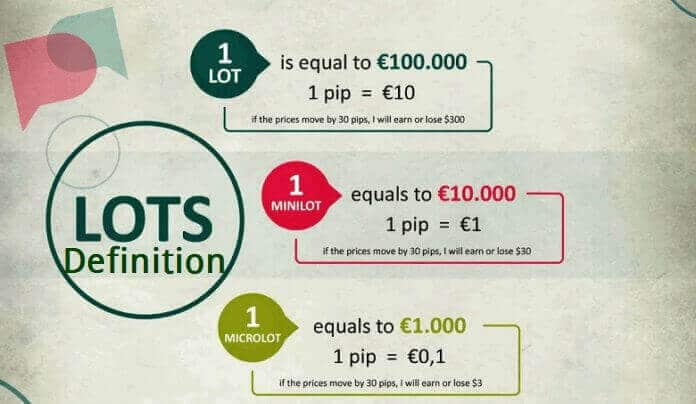

The standard size for a lot is 100,000 units of a currency pair but now different brokers offer their clients the facility to trade in Mini, Micro, and Nano lot sizes of 10,000, 1,000, and 100 units respectively.

At a glance the structure of the lot-

| Lot’s name | Number of units |

|---|---|

| Standard | 100,000 |

| Mini | 10,000 |

| Micro | 1,000 |

| Nano | 100 |

As you know from the previous article, the unit that changes the minimum price of a currency pair is called Pips which is a very small fraction of a currency.

If you want to make a big profit from this small change (Pips) then you must increase your trading unit/Lot.

Forex Lot Calculation:

Let’s assume, you are trading with a standard lot broker whose unit is 100,000, you will buy/sell in any currency pair here. Let’s calculate the profit/loss of entry as pips –

- USD/JPY at an exchange rate of 119.80: (.01 / 119.80) x 100,000 = $8.34 per pip

- USD/CHF at an exchange rate of 1.4555: (.0001 / 1.4555) x 100,000 = $6.87 per pip

In cases where the U.S. dollar is not quoted first, the formula is slightly different and this calculation will be a little different.

- EUR/USD at an exchange rate of 1.1930: (.0001 / 1.1930) X 100,000 = 8.38 x 1.1930 = $9.99734 Or We could say $10/pip

- GBP/USD at an exchange rate of 1.8040: (.0001 / 1.8040) x 100,000 = 5.54 x 1.8040 = 9.99416 Or We could say $10/pip

With an example below, we have tried to show how much the value of EUR/USD and USD/JPY pips will vary depending on the lot size.

| PAIR | CLOSE PRICE | PIP VALUE PER: | ||||

|---|---|---|---|---|---|---|

| Unit | Standard lot | Mini lot | Micro lot | Nano lot | ||

| EUR/USD | Any | $0.0001 | $10 | $1 | $0.1 | $0.01 |

| USD/JPY | 1 USD = 80 JPY | $0.000125 | $12.5 | $1.25 | $0.125 | $0.0125 |

Different brokers have their convention to calculate profit or loss in the trade as these pips. But no matter how the broker does this calculation, the broker will tell you how much the currency pair’s pips will be calculated at a given time or you can see them in the Client Agreement.

In other words, they do all the math calculations for you!

If you do not remember this calculation, just keep in mind the following calculations –

- For a buy or sell position on the EUR/USD currency pair at a standard lot broker, the profit/loss for a 1 lot size entry per pips movement will be $10.

- For a buy or sell position on the EUR/USD currency pair in a mini lot broker, the profit/loss will be $1 for 1 lot size entry per movement of pips.

- For a buy or sell position on the EUR/USD currency pair at a micro lot broker, the profit/loss for a 1 lot size entry per pips movement will be $0.10.

- For a buy or sell position on the EUR/USD currency pair at Nano Lot Broker, the profit/loss will be $0.01 for 1 lot size entry per movement of pips.

Leverage’s analysis!

You may be wondering, how can I trade such a large amount with such a small balance?

Suppose your broker is a bank that paid you $100,000 to buy/sell currency. As a condition, you are asked to deposit a certain amount of money. Suppose 1,000.

That is, instead of depositing $1,000 into your trading account, you get the opportunity to trade $100,000 in currency from a broker.

What do you think? Sounds too good to be true? This process is called leverage in the language of forex trading.

The amount of leverage will depend on your broker and your trading skills, that is, how much leverage your broker will pay you and how much leverage you feel comfortable receiving.

Usually, the broker will ask you to deposit funds for trading which is also known as Account Margin or Initial Margin. You are fully prepared to trade from the time you deposit funds in your trading account.

For example, if your leverage is 100:1 (or 1% position), and you want to take a trade position that is worth $100,000, but you have a balance of $5,000 to trade.

Then is it possible to take such a larger position with a small amount of money?

No problem, your broker will then deduct 1,000 from you (your balance) for the full value of the position as an installment/down payment which is called margin and will pay you the rest as a loan.

Of course, any losses or gains will be deducted or added to the remaining cash balance in your account.

This minimum security (margin) for each lot will vary from broker to broker.

From the example given above, the broker has set a margin of 1% for trading. This means that for every $100,000 traded, the broker wants $1,000 as a deposit on the position.

Let’s say you want to buy 1 standard lot (100,000) of USD/JPY. If your account is allowed 100:1 leverage, you will have to put up $1,000 as margin.

This $1,000 is NOT a fee or charge. This is the amount of your investment/deposit which will be returned to you as soon as you close your entry position.

How to calculate profit and loss?

Now that you know how to calculate the price and leverage of pips, we will know how to calculate profit and loss.

Suppose you took a buy entry in the USD/CHF currency pair, that is, you bought the USD currency as well as sold the CHF currency.

- The rate you are quoted is 1.4525 / 1.4530. Because you are buying U.S. dollars you will be working on the “ASK” price of 1.4530, the rate at which traders are prepared to sell.

- You then buy 1 standard lot (100,000 units) at 1.4530 prices.

- After a few hours, the price of this currency pair rose to 1.4550 and you decided to close this position.

- The new quote for USD/CHF is 1.4550 / 1.4555. Since you initially bought to open the trade, to close the trade, you now must sell to close the trade so you must take the “BID” price of 1.4550. The price that traders are prepared to buy at.

- You bought the currency pair at 1.4530 and closed at 1.4550. That means you made a profit from this currency pair.0020 or we can say 20 pips.

- According to the formula we learned to calculate pips, (.0001 / 1.4550) x 100,000 = $6.87 / pips x 20 pips = $137.40 You make a profit from this trade.

Bid-Ask & Spread

Remember, whenever you enter or close a trade, it is directly linked to the bid/ask price of that currency pair.

When you buy a currency, you need to see the ASK price of that currency pair.

When you sell a currency, you need to see the BID price of that currency pair.

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.

impressive

Good