May 11, 2021

Estimated reading time: 1 min

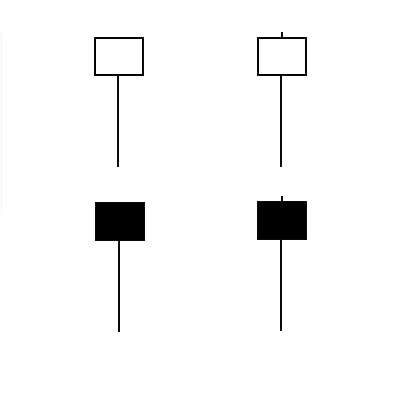

A Hammer is a single Japanese candlestick pattern.

It is black or a white candlestick that consists of a small body near the high with a little or no upper shadow and a long lower shadow (or tail).

A Hammer candlestick is considered a bullish pattern when formed during a downtrend.

A Hammer candlestick pattern should meet the following criteria:

- The candle must have either a very short upper shadow or no upper shadow at all.

- The candle’s lower shadow must be quite tall (at least two times as height of the body).

- The candle must form after a clear downtrend.

- The candle’s body should be located at the upper end of the trading range.

- The body’s color is unimportant (though a white candle hints at a more bullish bias).

- The candle should be confirmed the following day, with the price trading above the Hammer’s body.

Don’t confuse the Hammer with the Hanging Man.

A Hanging Man looks identical but only forms at the end of an uptrend, while the Hammer forms after a downtrend.

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.

Views: 87