Make Money From Forex Trading – Asking to you, what is Forex trading?

How to do Forex trading? or be specific ” How to Make Money From Forex Trading?”

In fact, in the Forex market, we have to buy or sell any currency pair.

It is very easy to take entry as a trade in the forex exchange market. The process of trading is similar to other financial markets, such as the Stock Market. So, if you have previous experience in stock trading, then you can understand Forex trading very easily. If you do not have such experience, then our website www.fxbangladesh.com will help you out.

The basic function of forex trading is to anticipate the change in price of one currency versus another currency. If we try to understand with an example,

Suppose you buy a currency pair and if the price increases in the future, you can make money trading forex by selling it. To analyze the trading actions –

| Trader’s Action | EUR | USD |

| You purchase 10,000 euros at the EUR/USD exchange rate of 1.1800 | +10,000 | -11,800* |

| Two weeks later, you exchange your 10,000 euros back into U.S. dollar at the exchange rate of 1.2500 | -10,000 | +12,500** |

| You earn a profit of $700 | 0 | +700 |

Calculation –

*EUR 10,000 x 1.18 = US $11,800

** EUR 10,000 x 1.25 = US $12,500

The exchange rate here refers to the value of one currency versus the other currency.

For example, if you say USD/CHF exchange rate indicates how many U.S. dollars can purchase one Swiss franc, or how many Swiss francs you get in exchange for one U.S. Dollar.

How to Read a Forex Quote

Forex trading currencies always exist as a pair. A Currency Pair means there will be Two different currencies. For example, USD/JPY. The main reason is that when it is exchanged, it means you are buying a currency and selling the other one.

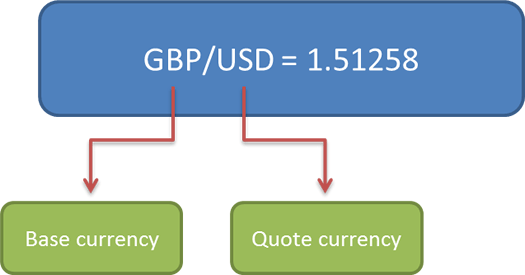

Below we are trying to illustrate the exchange rate of British pounds and American dollars through an image.

Please be noted, in the above figure we call the currency that is before the “/“, is called the Base Currency, from the above example, the base currency is GBP.

on the other hand, the currency that is at the end of “/“, is called Quote Currency. From the above example, USD is the quote currency.

When buying a currency pair this means that, to buy a unit of the base currency, how much quote currency is needed. According to the diagram above, buying 1 pound would cost you $1.51258.

On the contrary, when you SELL a currency pair, it means how much quote currency you get for the exchange of a base currency. According to the diagram above, if you sell 1 pound then you get 1.51258 US dollars. Hope you understand.

Always keep in mind –

The base currency is the main basis for Buying or Selling any currency pair.

So, if you accept a BUY entry in the EUR/USD currency pair, that means you are constantly buying the base currency and selling quote Currency. In terms of Forex Market then it stands – “BUY = EUR and SELL = USD”

- You will only take the currency pair BUY entry when you assume the base currency value will increase further than the quote currency.

- You will take the currency pair SELL entry only when you assume the base currency value will decrease from the present level, compared to the quote currency.

Long/Short

First, you have to decide, whether you are taken the BUY or SELL entry?

If you accept a BUY entry that means, you are buying the base currency and selling the quote currency. Assuming, its value will increase further and then can sell it at a higher price.

In terms of Forex Trading, it is called “Going Long” or taking long positions. You only have to remember, Long = BUY.

On the other hand, if you accept the SELL entry, it means selling the base currency and doing the quote currency buy. By which you think, the price or value of the base currency will decrease, then you can buy it again at a lower price.

In terms of Forex Trading, it is called “Going Short” or taking short positions. You only have to memorize, Short = SELL.

Bid, Ask, and Spread

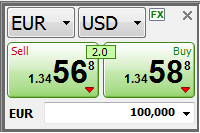

You will see two types of prices when trading any currency pair. One of them is BID and the other is ASK. The bid price is always lower than the Ask price.

BID Price is, your broker will buy the base currency against the quote currency at this price. This means BID is the best price in the market where you (the trader) can SELL it. Remember, if you accept a currency pair SELL position, the broker will buy it from you through the bid price.

Ask price is, your broker will sell the base currency against the quote currency. This means, ASK is the best price in the market where you (the trader) can buy it. Remember, if you accept a currency pair BUY position, the broker will sell it to you through Ask Price. The ask price is again called “Offer Price“.

We hope to present the details of the Bid and Ask price. Now the question is what is Spread? Simply, the spread is the price gap or the difference between the bid and the ask price.

Please take a closer look at the image provided above. The EUR/USD currency pair has two price ranges where the bid price is 1.34568 and the ask price is 1.34588.

- If you want to SELL the EUR currency, you can click on the SELL button and see the price there – 1.34568

- If you want to BUY the EUR currency, you can click on the BUY button and see the price there – 1.34588

If you do not understand, please try to simplify the issue in the image below –

Hopefully from the image above, we have been able to simplify things for you. So let’s do some calculations this time and we can learn more details about make money from forex trading.

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.