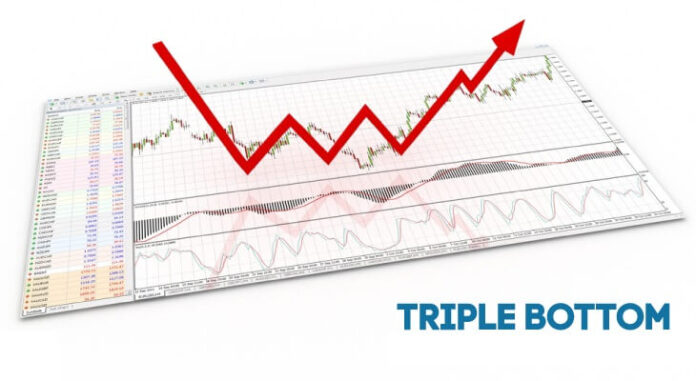

A Triple Bottom is a chart pattern that consists of three equal lows followed by a break above resistance.

The chart pattern is categorized as a bullish reversal pattern.

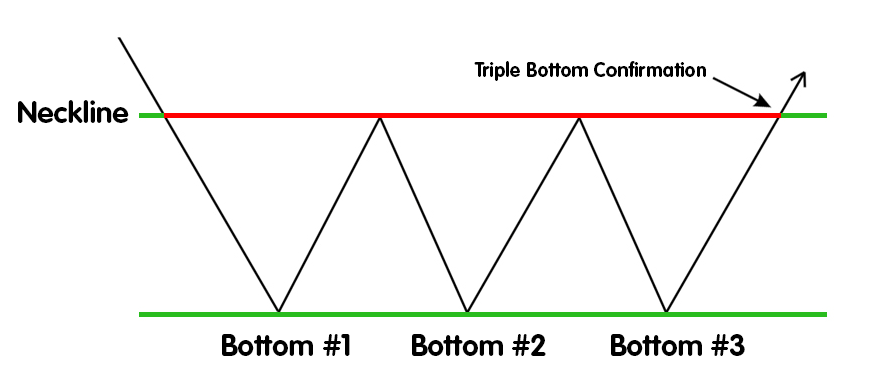

All three highs should be reasonably equal, well-spaced, and mark clear turning points to establish support.

The lows do not all have to exactly the same level but should be “close enough”.

That said, patterns where the last bottom is higher than the middle usually provide better results.

The Triple Bottom pattern is similar in appearance to the Inverse Head and Shoulders pattern, in that it is represented by a series of three high highs and lows.

The difference is that all three highs of the Triple Bottom will be around the same height, while in the Inverse Head and Shoulders pattern, the second lowe is lower than the first and third high.

The appearance of the Triple Bottom indicates the existence of a downtrend, which is currently in the process of reversing into an uptrend.

Selling pressure is declining so the downtrend is running out of steam.

As with a Triple Top, it is generally thought that the longer a particular trend takes to fully develop, the stronger the significant change in price once a breakdown occurs.

Triple Tops and Bottoms are considered one of the slowest types of chart patterns to fully mature.

While the Triple Bottom is developing, it can look like other chart patterns.

For example, before the third high form, the pattern may look like a Double Bottom.

Three equal highs can also be found in a Descending Triangle or Rectangle.

With a Triple Bottom, the support level can be identified by drawing a line at the base level of the high, which forms a “Neckline“.

You can choose to enter into a long position once the price level rises through this resistance level.

The Triple Top should also be treated as a neutral chart pattern until a breakout occurs.

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.