McClellan Oscillator Intro

The McClellan Oscillator is a technical indicator for determining the behavior of an overall market, rather than the behavior of a single asset.

The Oscillator was developed by Sherman and Marian McClellan for use with the New York Stock Exchange (NYSE) and is currently carried on by their son Tom.

It is essentially a look at the momentum of the underlying breadth of the market.

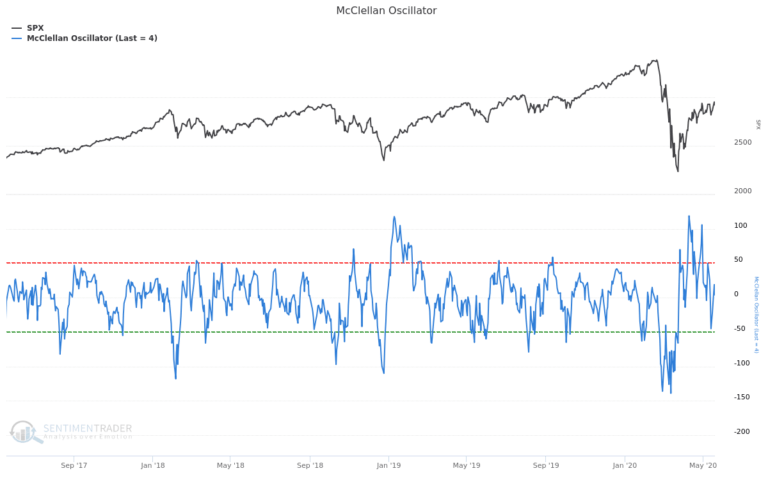

When it is above zero, momentum is positive; below zero, it is negative.

It also works as an overbought/oversold indicator when it pushes above +100 or below -100, respectively.

During times of major trend change, the indicator will often hit an extreme, then the market will fail to react, suggesting a change in the market’s tone and a higher probability that the overall trend is changing.

How does it work?

The McClellan Oscillator is taken by first subtracting the advancing assets from the declining assets for the entire market to determine the net advances and declines for the market.

Two moving averages are taken of this net market behavior, one for a 39 day period and one for a 19-day period.

The difference between these two moving averages, formed by subtracting the 39-day average from the 19-day average, forms the McClellan Oscillator.

- When the McClellan Oscillator is positive, advances are dominant in the market.

- When the Oscillator is negative, declines are dominant.

Traders take this as a signal of the overall momentum for a market.

Overbought / Oversold

Signals in excess of 100 or -100 are signs that a market is either overbought or oversold, respectively.

- If the Oscillator moves from -100 or below into positive numbers, a buy signal is generated.

- If the Oscillator moves from 100 or above into negative numbers, a sell signal is generated.

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.