Handles are relevant to all financial markets, but mean different things depending on the asset.

When it comes to trading, the term “handle” has two meanings, depending on which market you are referring to.

How Handle is Used in FX

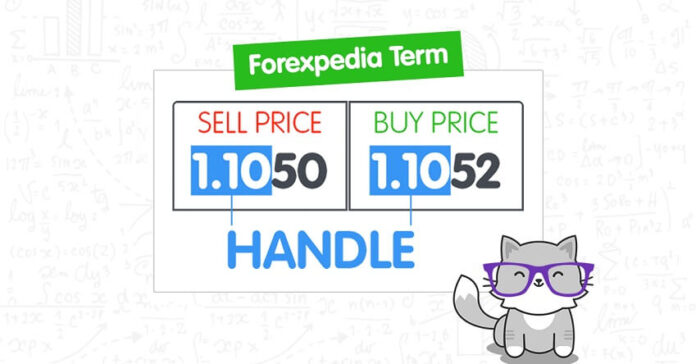

In forex, it refers to the part of the quote that you see in both the buy AND sell price.

For example, if the EUR/USD has a bid of 1.1050 (sell price) and an ask of 1.1052 (buy price), the handle would be 1.10.

This is the part of the quote that is equal to both the buy and sell price.

Since most FX prices are quoted out up to five decimal places. forex traders find it more convenient to just refer to the last two decimal places when discussing the bids and asks, and exclude the handle.

How Handle is Used in Other Markets

In other markets, a handle means the whole numbers involved in a price quote, without the decimals included.

It is the portion of the quote to the left of the decimal point.

For example, if a stock is trading at $82.49, its handle is just $82.

In the stock market, a handle is also known as the “big figure” or “big fig“.

Using the handle is a faster way of referring to the price of an asset at a particular point in time.

It’s a verbal shortcut.

When traders know what the handle of the specific quote price is, it eliminated the need to say the entire full quote price when talking to other traders.