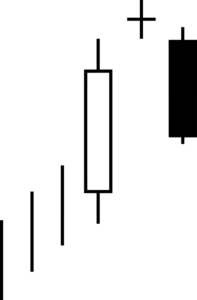

An Evening Doji Star consists of a long bullish candle, followed by a Doji that gaps up, then a third bearish candle that gaps down and closes well within the body of the first candle.

An Evening Doji Star is a three candle bearish reversal pattern similar to the Evening Star.

The only difference is that the Evening Doji Star needs to be a Doji candle for the second candle.

To identify an Evening Doji Star pattern, look for the following criteria:

- The first candle should be a tall white candle in an upward price trend.

- The second candle should be a Doji whose body gaps above the first and third candles. Shadows are ignored.

- The third candle is a tall black candle that closes at or below the midpoint of the first candle

Meaning

This Evening Doji Star acts as a bearish reversal of the upward price trend because the price rises into the pattern and breaks out downward.

A downward breakout occurs when the price closes below the bottom of the three-candlestick pattern.

Since the price in the last candle is already near the low, a downward breakout is expected.

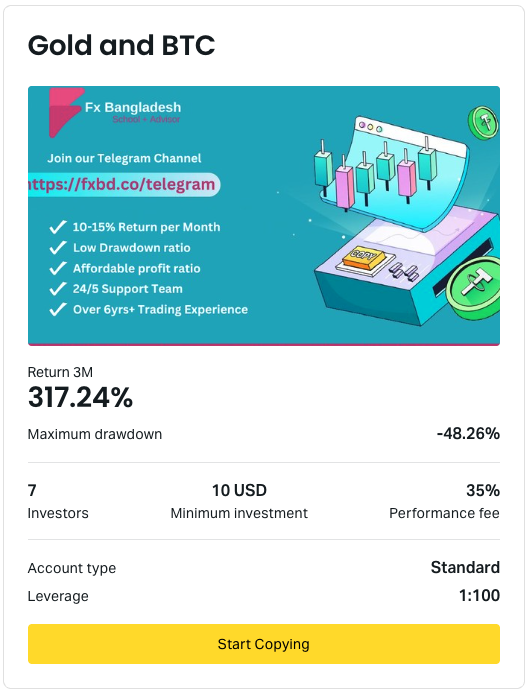

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.