May 5, 2021

Estimated reading time: 1 min

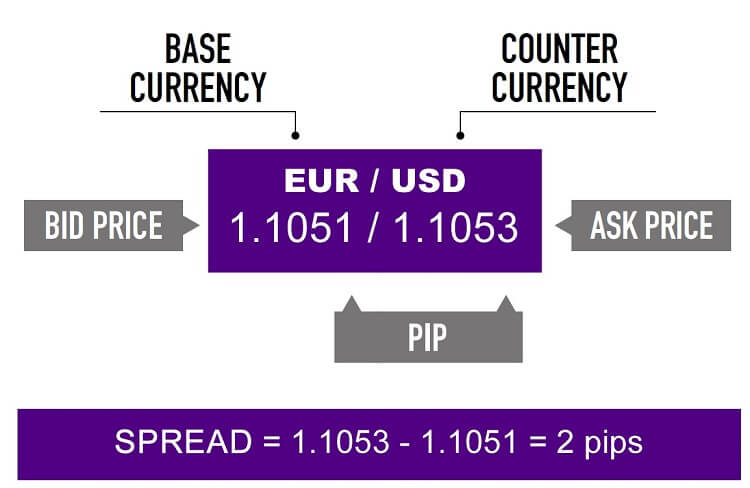

The bid is the amount that your broker is willing to pay in order to buy a financial instrument.

It is the opposite of an ask, which is the price that a seller will take in order to part with a financial instrument.

In forex, this is the price that you, the trader, may sell the base currency.

Bids usually comprise two elements:

- The price which the buyer is willing to pay

- The quantity of the financial instrument they are looking to purchase.

A trade is executed when a matching bid and ask are combined.

For example, a trader bidding 110.25 for 1,000 units of USD/JPY will see their trade executed when a seller agrees to that price and level.

The bid (the price at which you can sell an asset) is quoted as lower than the ask, and the difference between the two is known as the spread.

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.

Views: 46