The accumulation area represents a period of buying, typically by institutional buyers, while the price remains fairly stable.

On a price chart, the accumulation area is described by mostly sideways price action with above-average volume.

It may signal that large institutional traders are buying, or accumulating, large quantities of an asset over time.

The accumulation area is important for traders to recognize when making buy and sell decisions.

Identifying the accumulation area helps traders spot good entry points before the price begins to rise.

The accumulation area signals the possibility of a breakout.

When price doesn’t fall below a certain price level and moves in a sideways range for an extended period, this can indicate that the asset is being accumulated by institutional buyers and as a result will breakout to the upside soon.

The opposite of the accumulation area is the distribution area.

The distribution area is where institutional traders begin selling.

Being able to recognize whether an asset is in the accumulation zone or the distribution zone is critical to trading success.

The goal is to buy in the accumulation area and sell in the distribution area.

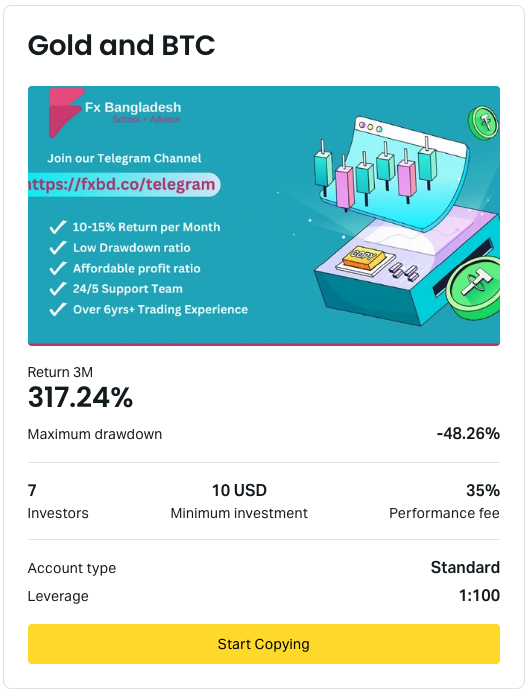

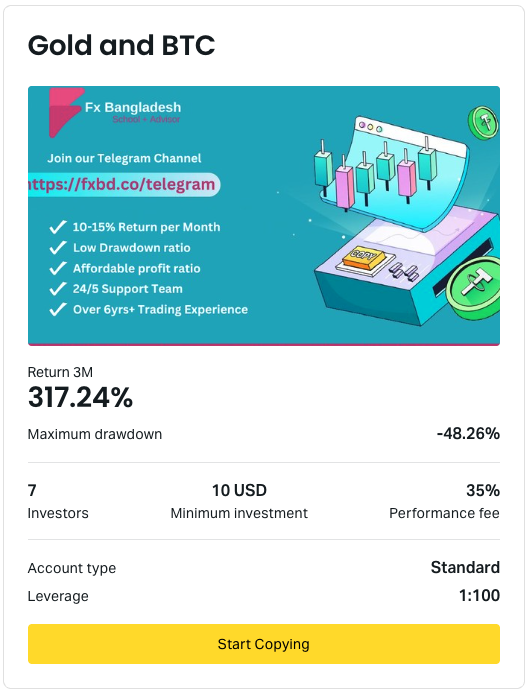

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.