Technical analysis is the study of historical price action in order to identify patterns and determine probabilities of future movements in the market by studying price action and through the use of technical indicators and chart patterns.

Technical Analysis focuses on using a price chart to identify the trend, support and resistance, and momentum to help traders get into and out of higher probability trades.

A technical analyst believes that prices move in trends, and price movements generally follow established patterns that can be partly attributed to market psychology based on the widely-held belief that participants in markets react in a similar fashion when faced with similar situations.

Technical analysis does not attempt to measure an asset’s underlying value, but rather, uses price charts and technical indicators to identify patterns that can be used as a basis for trade entries and exits.

The main difference between technical analysis and fundamental analysis is that technical analysis’ exclusive use of historical price and volume data.

Technical analysis is concerned with the future, and the best predictor of future price movements is past trading information and data.

Forex traders who use technical analysis believe that price patterns tend to repeat themselves in the future, they’ll analyze a currency pair’s previous price movements, and use those to decide when to enter and exit positions.

The overarching principle of technical analysis is that an asset’s price already reflects all available information and instead focuses on the statistical analysis of price movements.

It boils down to an analysis of supply and demand in the market to determine where the price trend is headed.

The main theory of technical analysis is:

- Recent price developments allow you to understand what the buyers and sellers on the market are thinking.

- You can then tell whether it is buying or selling interest that is increasing.

- This allows you to deduce what the market participants may do next.

The field of technical analysis is based on three underlying assumptions:

- The market discounts everything. The price of a currency pair automatically factors in “fundamentals” (macroeconomic conditions). The impact of events such as interest rate changes, or the latest employment reports is automatically factored into the price through the actions of buyers and sellers in the market.

- Price moves in trends

- When it comes to pricing, history tends to repeat itself.

Technical analysis tries to achieve three main objectives:

- Profit from trading by observing market patterns and statistics.

- Know when to enter and exit a market, especially when it starts to shift.

- Avoid letting emotions influence trading decisions.

Because technical analysis is based on the emotions of traders, it is only effective in auction markets, where many buyers and sellers converge to a single price that is determined by the highest bid price and the lowest ask price.

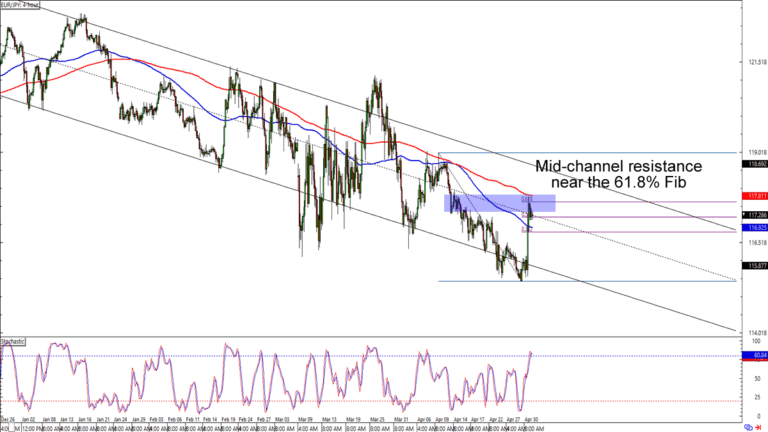

Technical analysis boils down to two things:

- Identify the trend.

- Identify support/resistance through the use of price charts and/or timeframes.

Markets can only do three things:

- Move up.

- Move down.

- Move sideways.

Prices typically move in a zigzag fashion, and as a result, price action has only two states:

- Range: when prices zigzag sideways

- Trend: when prices either zigzag higher (uptrend) or prices zigzag lower (downtrend)

There are 3 types of tools and techniques used in technical analysis:

- Price Action: Studying past price movements to identify any clues on where the market could move next. Includes drawing chart lines to discover where prices tend to react.

- Chart Patterns: Identifying major chart patterns that predict where prices will be headed.

- Technical Indicators: Using statistical tools to identify buy and sell signals.

Why is technical analysis important?

Technical analysis can help you determine not only when and where to enter a trade.

And just as importantly, when and where to get out.

How can you use technical analysis?

Technical analysis is based on the theory that the markets are chaotic (no one knows for sure what will happen next), but at the same time, price action is not completely random.

Within a state of chaos, there are identifiable patterns that tend to repeat.

This means that successful trading using technical analysis is NOT about being right or wrong

It is about determining probabilities and taking trades when the odds are in your favor.

Part of determining probabilities involves trying to determine future price direction and when/where to enter into a position.

But equally important is determining your risk-to-reward ratio.

There s no magical combination of technical indicators that will unlock some sort of secret trading strategy.

The secret of successful trading is good risk management, discipline, and the ability to control your emotions.

Anyone can guess right and win every once in a while, but without risk management, it is virtually impossible to remain profitable over time.