A Dragonfly Doji is a type of single Japanese candlestick pattern formed when the high, open, and close prices are the same.

It signals a potential reversal.

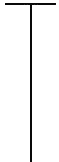

The candle ends up with a tall lower shadow and no body.

It is usually seen at the bottom of a downtrend.

A Dragonfly Doji is more bullish than a hammer.

To identify a Dragonfly Doji, look for the following criteria:

- The Dragonfly has a long lower shadow but no upper shadow, and it resembles the capital letter T.

- The candlestick is formed when the opening and the closing prices are at the highest of the session.

Meaning

The Dragonfly Doji is bullish.

A Dragonfly Doji signals that the price opened at the high of the session. There was a great decline during the session, and then the price closed at the high of the session.

The result is that the open, high, and close are all the same (or about the same) price.

This candlestick’s presence is most significant when it appears after a downtrend, preceded by bearish candlesticks. It suggests that the downtrend may be coming to an end.

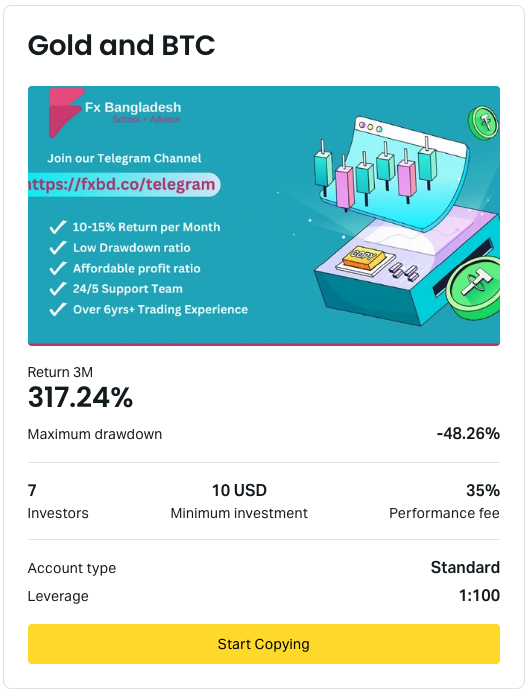

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.