Currency risk is the impact of currency fluctuations on the value of a company’s cash flows or on its accounting position.

The quantification of currency risk is known as “exposure” or “risk exposure.”

The two major types of currency risk exposure are:

- Economic exposure

- Accounting exposure

Economic exposure is concerned with a firm’s cash flows; it results from combining operating exposure and the cash-flow elements of transaction exposure.

Accounting exposure is concerned with a firm’s foreign currency denominated assets, liabilities, revenues, and expenses as shown in its financial statements.

It results from combining translation exposure and the accounting elements of transaction exposure.

What is operating exposure?

Operating exposure to foreign exchange risk is the impact of exchange rate changes on a company’s future operating revenues and costs.

To the extent that a firm’s competitive position is affected by changes in exchange rates, it has operating exposure, even if it does not deal with foreign currencies.

Thus a ski resort in Chile, with no FX transactions, has operating exposure to FX risk if a devaluation of the Argentine peso draws customers to cheaper destinations in the neighboring country.

What is transaction exposure?

Transaction exposure measures the effect of exchange rate on foreign currency denominated transactions—sales and purchases for which a contract is in place.

For example, an exporter with EUR as its functional currency has an agreement to sell finished goods to a US client in three months’ time.

The export, denominated in USD, is to be settled another three months after the goods are delivered.

The time span between the moment the sale is initiated and settled creates currency risk as for the EUR cash flow as the EUR-USD rate fluctuates.

When the corresponding foreign currency denominated accounts receivable/payable are issued and appear on the firm’s balance sheet, the transaction creates accounting exposure as well.

What is translation exposure?

Translation exposure to currency risk is the effect of exchange rate changes in the current balance sheet and income statement.

Translation exposure comprises the foreign currency gains and losses that occur when a group’s financial statements are consolidated and the accounts of foreign subsidiaries are translated into the home currency.

FX translation can be carried out by expressing all balance sheet and income statement items at the current exchange rate, or by applying different exchange rates (current rate/historical rate) to different assets and liabilities on the balance sheet.

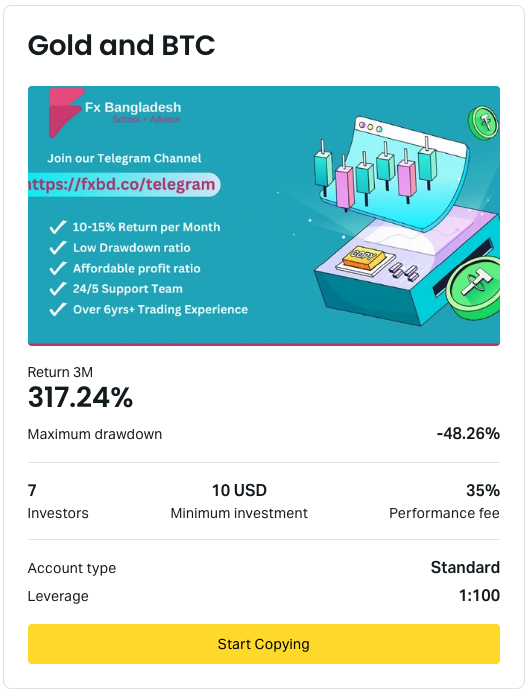

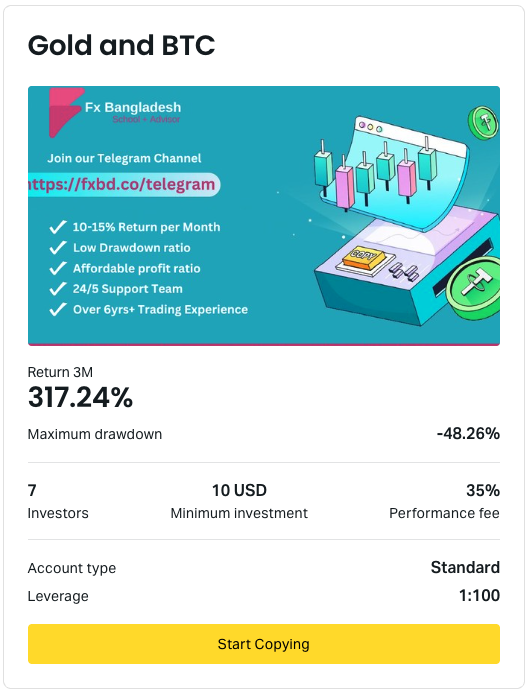

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.