May 5, 2021

Estimated reading time: < 1 min

In trading, correlation is a measurement of the relationship between two assets.

A positive correlation suggests that Security B will move in the same direction as Security A.

For example, the German stock market (DAX) and EUR/JPY moved in the same direction from 2004 to 2010. That is, EUR/JPY rose when DAX performed well and plummeted when the stock market dropped.

A negative correlation suggests that Security B will move in the opposite direction of Security A.

An example is a correlation between EUR/USD and the dollar index (USDX). A strong dollar would usually lift USDX, but it will also boost the dollar against the euro, resulting in downward price action for EUR/USD.

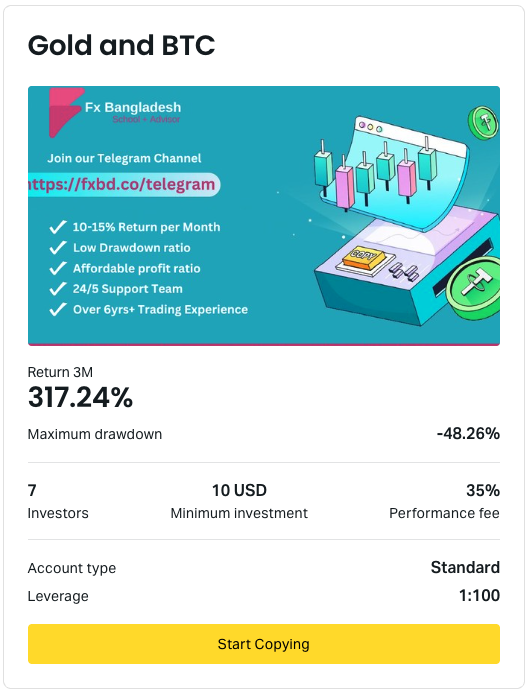

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.

Views: 86