May 5, 2021

Estimated reading time: 1 min

In this article

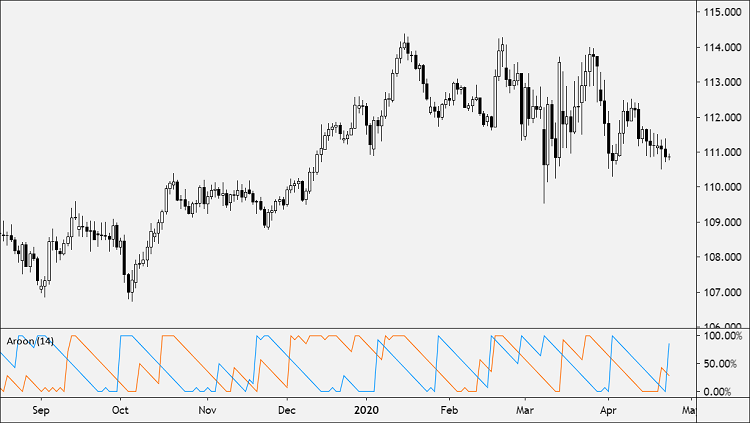

The Aroon Up/Down technical indicator identifies when the price is in a trend or trading sideways.

It was developed by Tushar Chande, who used the word “aroon” due to its meaning in Sanskrit: “dawn’s early light” or “the change from night to morning”.

The indicator uses two lines: Aroon Up and Aroon Down.

- Aroon Down is a measure of how close the current bar is to the most recent lowest Low bar found in the last N bars.

- Aroon Up is a measure of how close the current bar is to the most recent highest High bar found in the last N bars.

The Aroon Up/Down indicator ranges from 0 to 100.

The default period is 14 days.

How to Use Aroon Up/Down

- If the price makes a new 14-day high, the Aroon Up = 100.

- If the price makes a new 14-day low, the Aroon Down = 100.

- If the price does not make a new high in 14 days, the Aroon Up = 0

- If the price does not make a new low for 14 days, the Aroon Down = 0.

Similar to the ADZ indicator, the Aroon indicator is used to determine if the market is trending or not.

A related technical indicator, the Aroon Oscillator can be defined as the difference between the Aroon Up and Aroon Down values.

If you liked this article, then please subscribe to our Newsletter Services for Forex Related updates. You can also find us on Facebook and can subscribe to our YouTube channel. You can also join our Telegram Channel for real-time trading analysis and discussion. Here is our service sitemap. If you have any confusion please leave your comments below.

Views: 24